VIVANESS 2019: Natural and organic cosmetics have tremendous potential

Market researchers are seldom in as much agreement as they are about natural and organic cosmetics: The megatrend continues. Dynamic growth rates are proving that the worldwide demand for natural beauty products is uninterrupted. This development is driven by the desire for milder, more skin-friendly, nature-based care. The market for natural and organic cosmetics – with or without certification – is profiting tremendously and gaining new buyers on an international scale. Global developments within the sector are particularly exciting: Natural and organic cosmetics are extremely popular with buyers and are driving market development. The entire cosmetics industry is becoming greener and sustainability is high on the agenda of many companies. The sector will come together in all of its diversity at the next VIVANESS, International Trade Fair for Natural and Organic Personal Care, from 13 to 16 February 2019 in Nuremberg.

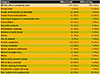

“The demand has long reached global proportions and the global market for organic and natural cosmetics is growing rapidly,” says Amarjit Sahota of London-based Ecovia Intelligence, in summarizing developments. According to the latest figures from specialised market research companies, the sector achieved global sales of US$ 10.2 billion in 2017, a growth of more than 6 percent compared to the previous year. At around US$ 4.9 billion, North America is the largest market for organic and natural cosmetics, followed by Europe at about US$ 4.1 billion. The European leader is Germany, with its broad acceptance in the trade, its successful pioneering brands, and sales of around 1.2 billion euros. France and Italy are second and third among the natural and organic cosmetics nations with the highest turnover.

Germany continues in the lead position

Thanks to a consistently favourable consumer climate, the largely saturated German cosmetics market (13.6 billion euros) grew a substantial 2 percent during the first half of 2018, as reported by the German Cosmetic, Toiletry, Perfumery and Detergent Association (IKW). The organic and natural cosmetics sector remains a growth driver. According to market expert Elfriede Dambacher of naturkosmetik konzepte in Dortmund, Germany, the market grew 3.1 percent during the first half of 2018, gaining approximately 1.2 million new customers over the past two years. According to the Nuremberg-based Gesellschaft für Konsumforschung (GfK – Consumer Research Association), turnover increased by about 8 percent. As a result, the German market will continue to occupy the number-one position in Europe. The chemist markets, which are a leading sales channel for natural and organic cosmetics in Germany, as well as discounters and branch-based food retailers are pursuing a pricing strategy causing strong competition and declining average prices that influence the growth in sales. However, the dynamics of demand and the importance of product diversity for the overall market are reflected in a natural and organic cosmetics market share of almost 9 percent and in the fact that over the past year alone, some 800,000 new consumers have opted for natural and organic cosmetics.

France: high consumer interest

As a cosmetics nation, France has been registering an increased interest in natural and organic cosmetics products on the part of consumers for years. It’s the second largest natural and organic cosmetics market in Europe after Germany. The results are extremely impressive, with an estimated turnover of 500 million euros, growth of around 10 percent and a market share of about 4.5 percent. According to the market indicators of Agence Bio, four out of ten French consumers bought more natural and organic cosmetics than conventional cosmetics in 2017. The Cosmebio association, whose seal is known by around 80 percent of French consumers, is calling this development a success story. The growth in demand is accompanied by an increase in product diversity and the availability of organic specialist trade via traditional sales channels. Parapharmacies and online retailers play a major role. Total cosmetics sales in France amount to 11.4 billion euros.

Natural and organic cosmetics still have tremendous growth potential: In a representative survey by the Parisian market research company Xerfi Research quoted in the Natural Cosmetics Annual Report (naturkosmetik konzepte, Dortmund, Germany), around 70 percent of respondents expressed an interest in natural care products based on a desire for quality, safety and environmental protection. Specifically, consumers are looking for well-tolerated products that are parabens-free and contain a high percentage of natural ingredients. According to the information service L’Oberservatoire des Cosmétiques (OBS, Paris), 85 percent of customers also expect transparent labelling that they can consult for guidance. In this respect, a positive development in the market always brings additional challenges: Both manufacturers and retailers must keep pace with consumers’ high expectations.

Italy: a strong market for natural beauty

The desire for natural and organic personal care products is also a consistent trend in Italy. Confirming the persistence of the green trend, a study by the cosmetics association Cosmetica Italia revealed that of the over 3,700 cosmetics products on the market in 2017, half were in the “green cosmetics” category. As macro-trend for the next ten years, Cosmetica Italia predicts that consumers will expect green cosmetics to contain more and more organic ingredients, to be produced using ethically correct practices, and to be contained in eco-friendly packaging. It is also important to note that today’s cosmetics industry is already relying more heavily on natural ingredients and is looking for alternatives to mineral oil derivatives. Generally speaking, however, the distinction between genuine natural and organic cosmetics and nature-inspired products is not as clear-cut on the Italian market as it is in Germany or France. Nevertheless, according to Cosmetica Italia, 54 percent of Italian consumers consider organic certification for cosmetics to be either very important (30 percent) or important (24 percent).

One of the most important distribution channels for natural and organic cosmetics in Italy is the erboristerias (herbalist shops, chemists). These specialist businesses offer a wide range of natural body care and cosmetics products as well as organic and natural cosmetics. With natural cosmetics sales of around 440 million euros in 2017 (Cosmetica Italia), erboristerias could be considered one of the most important sales channel for natural and organic cosmetics in the strictest sense, along with organic specialist shops. The Bio Bank company, which specialises in the Italian organic market, lists about 430 retail outlets for certified natural and organic cosmetics in its report, “Rapporto Bio Bank 2018”. Market experts estimate sales of organic and natural cosmetics to be about 4 percent of the overall market. According to Cosmetica Italia, chemists, perfumeries, supermarkets and, to a growing extent, e-commerce are responsible for a turnover of 660 million euros. Altogether, the cosmetics association estimates the market for green cosmetics (natural and nature-inspired) to be around 1.1 billion euros. This is approximately 10 percent of the total cosmetics market of 10.1 billion euros, which experienced a 1.7 percent increase in sales in 2017.

Each market is unique – ISO creates global guidelines

“The maturity and characteristics of natural and organic cosmetics within the individual markets reveal the cultural differences between the various countries and also depend on the particular trade patterns. The role of certified natural and organic cosmetics also differs from country to country,” explains market expert Elfriede Dambacher of naturkosmetik konzepte. The German, French and Italian markets all clearly demonstrate that certification has more significance in core Western European markets than in international markets. In global markets, the boundaries between degrees of naturalness are more fluid. Nature-inspired brands are experiencing greater growth while greenwashing continues to play a major role. But according to Dambacher, the fact remains that consumers in all markets prefer “natural & green beauty” and this is “an irreversible trend”. Due to the consistent growth in the demand for greener products, the international organization ISO, in collaboration with the cosmetics industry, has established a guideline (ISO 16128) that uniformly regulates natural ingredient content.

Green beauty versus greenwashing

According to Amarjit Sahota, the founder and owner of Ecovia Intelligence, 90 percent of consumers buy natural and organic cosmetics to avoid exposing their bodies to synthetic chemicals. This positive development also has its downside. Like other market insiders, Sahota considers greenwashing to be one of industry’s greatest challenges. “Many conventional brands rely on green and natural attributes for their marketing,” he says. According to information from the Kline Group, an international market research company, the global turnover of brands positioned as “natural” rose 9 percent and was well over US$ 35 billion in 2016. The increasing global demand for milder cosmetic products and the marginal growth of the largely saturated Western cosmetics markets are also fostering interest. Large cosmetics companies are purchasing green expertise by acquiring traditional natural and organic cosmetics brands. This fact plus the sustainability megatrend have taught today’s consumers to be sceptical. In addition to quality, major importance is attributed to ethical aspects, fairness and transparency – including with regard to a brand’s ownership.

Continued positive development, but with a demand for guidance

Where is the natural and organic cosmetics sector headed? Wolf Lüdge, managing director of the naturkosmetik verlag publishing company based in Wetzlar, Germany, and organizer of the annual industry congress for natural and organic personal care in Berlin, sees these developments as extremely positive. “Natural and organic cosmetics are part of the future because many values are attributed to them that are important to our cultural and social development. That’s why the share of natural and nature-inspired cosmetics in the overall market will continue to grow. It’ll be exciting to see which brands manage to take part in this trend and how the distribution landscape continues to develop in the future.”

The situation is also interesting for many industry players who are looking for guidance. The large number of parameters that go into assessing products, brands and markets makes the task increasingly complex. VIVANESS offers a unique platform for visitors, exhibitors and experts who are looking for a first-hand, comprehensive overview of global developments and trends in this dynamic market. In addition to the trade fair, VIVANESS also provides the special show Breeze with selected newcomers and indie brands, the “Innovation made in Germany” pavilion, and the Novelty Stand. The International Trade Fair for Natural and Organic Personal Care is also known for its exacting approval criteria, its clear dissociation from greenwashing, and its international focus. With its wide range of offerings, VIVANESS – held in conjunction with BIOFACH, World’s Leading Trade Fair for Organic Food – provides genuine guidance for industry and trade.

VIVANESS 2019: Save the date!

Next year, the exhibition duo of VIVANESS and BIOFACH will be held from?13 to 16 February 2019?at the Nuremberg exhibition venue.

for journalistsstina Kerling, Marie-Claire Ritzer-Berendt

Press team VIVANESS?

NürnbergMesse GmbH