Organic market expanding worldwide

Encouraging growth rates for organic agriculture and marketing

A good 2,000 exhibitors, of whom two thirds come from abroad, and over 33,000?trade buyers are expected at BioFach?2006 in the Exhibition Centre Nuremberg from 16-19 February. This time, exhibition activity focuses on the new EU member Poland as Country of the Year. Following a rather hesitant initial development of organic agriculture, today’s "organic revolution" is advancing with seven-league boots. There is a lively demand for organic sausage, herbs, juices, fruit and vegetables from Poland. In 2006, the natural personal care trade fair celebrates its première as a separate event parallel to BioFach. With some 200 exhibitors in a separate exhibition hall and a self-assured advertising presentation, it will do even more justice to its outstanding reputation as the most important international trade fair for natural personal care products. The distinctly enlarged organic wine segment is also presented in its own hall with some 250 suppliers of wine, sparkling wine and champagne. The necessary background information at the biggest organic wine exhibition is provided by the Wine Forum in the centre of the hall, and there are naturally plenty of opportunities for tasting.

Organic agriculture and marketing of organic products are growing almost everywhere in the world. Whereas some countries rely on export, organic marketing continues to develop especially in the

West European countries, the USA and Japan, where different forces affect market success. In Great Britain and Switzerland, it is clearly the conventional chain stores that claim the biggest market

share. In France and Germany, independent specialist shops boost the industry.

Amarjit Sahota from the British corporate consultant Organic Monitor estimates the world market for organic food in 2004 at 27?billion US dollars. "The growth was 8-10?%, with the largest

increase observed in North America. There was also healthy growth in Europe. Asia is expanding, as production is growing in countries like China, India and Thailand. The high worldwide growth rates

will continue in 2005," says Sahota.

Growth markets for organic products in France and Great Britain

The French organic product market of 1.7?billion EUR is about half as large as the German market. The organic share of the total food market is 1.3% (Germany: 2.4%). The driving force for growth is the specialized trade with its 2,500 organic food shops, health food shops and organic supermarkets. The study conducted by the German-French corporate consultant Ecozept estimates 12% growth for the organic food sector in 2004. Two thirds of the organic food shops examined in France had sales growth to show, with especially organic supermarkets doing very well with average rises of 17%.

Whereas Germany is one of the cheapest countries for consumers in Western Europe in terms of prices in the conventional retail food trade, the high level of prices in France is also reflected in

the organic food sector: Consumer prices for organic food in both organic food shops and the conventional trade are around 30% above the prices in Germany. According to a spot check carried out by

Ecozept, 80?% of organic food in France is distinctly more expensive than in Germany.

Great Britain can also be pleased about years of very good growth rates. Although the annual increase of 20-30% around the turn of the century has meanwhile dropped to some 10%, the organic market

there is still growing strongly. Every household spends 59 British pounds (87 EUR) a year on organic products. The demand has risen tenfold over the last ten years – from 100 million GBP in 1993/94

to 1.12 billion?GBP (1.6 billion EUR) in 2003/04. Despite growing demand, the area under cultivation has dropped in the last two years, by 5?% to 688,000 ha in 2004. This corresponds to a share of

4% of the land used for agricultural purposes.

Austria’s organic farmers aiming for 8% share of food market

"Organic is still a success story in Austria," says Johannes Tomic, spokesman for Bio Austria, the new federation for organic farmers. On setting up Bio Austria, the three farming associations Bio Ernte Austria, Arge Biolandbau and ÖIG were transferred to Bio Austria. Bio Austria’s target is to double the organic share of the market to 8% by 2008. Every tenth farmer in Austria already uses organic methods: 20,000 organic farms work 13.5?% of the agricultural area. Bio Austria thinks the number of organic farmers should grow by 10% every year.

Austria’s organic farmers currently achieve sales of 400 million EUR with their produce. 70 % of this is sold in the retail food trade, 10 % is sold by direct marketing, 12 % is processed by

canteens and 8 % is exported. Bio Austria sees potential especially in canteens and export. 40,000 canteen meals a day are already prepared from organic food in Vienna, with a rising tendency.

Austria currently exports about one third of its organic potatoes to Great Britain. The organic farmers together with Agrarmarkt Austria (AMA) Marketing have agreed on full quality assurance for

organic food. The start signal for even better quality control is planned for January 2006.

Swiss are world champions in organic enjoyment

Switzerland not only has the highest Alpine peak, but also enjoys the most organic food. The average Swiss spends 150 CHF (97?EUR) on organic products. This is more than twice as much as in Germany (42 EUR) and almost three times as much as in the USA (35 EUR). Although the number of organic farms (+2?%) and the organic market (+3?%) grew only slightly in 2005, the country is still one of the front-runners by international comparison. 11% of the farms use organic methods, which gives Switzerland third place in the world after Liechtenstein and Austria (Manual of Organic Agriculture in Switzerland 2005, published by the Research Institute of Organic Agriculture (FiBL) in co-operation with Bio-Suisse). FiBL and Bio Suisse think organic agriculture will continue to grow, although no longer as strongly as a few years ago.

The driving force in marketing is Coop Switzerland, whose broad-based range of products accounts for 51% of organic sales. 25?% is attributed to Migros and only 15?% to the specialized trade. 5% is

marketed directly and the rest is sold over the counter in the food craft trade.

Organic market booming in Germany

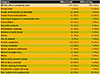

2004 was an extremely successful year for the whole organic industry in Germany. Sales rose by 13% to 3.5billion?EUR. The benefit of this encouraging increase differed between the individual marketing channels. The organic food trade grew by 15?% and the conventional retail trade by as much as 17%. Drugstores with the rapid turnover of their core range of non-perishable products and baby food achieved the highest growth rates (+25%) – but from a lower starting basis (Prof. Ulrich Hamm/Kassel in ZMP Ökomarkt Forum). The direct marketers achieved less growth, but still managed 8%. Most organic products are sold over the counter in the conventional retail food trade (36.5?%), followed by the organic food trade (26%), direct marketers (16%), health food stores (7.5%) and food craft trade and other marketing channels such as drugstores with 7?% each.

20,909 German companies produce, process or import organic food (Federal Statistics Office). Most of them are in Bavaria and Baden-Württemberg (approx. 5,700 each).

As the prices for organic food are tending to drop, the farmers are currently not particularly willing to convert. The organic area grew only slightly in 2004 to reach some 760,000ha, which

corresponds to 4.5?% of the land used for agricultural purposes. Just under 4% of all farms use organic methods.

The official German organic label introduced in September 2001 is advancing triumphantly. Around 30,000 products from 1,400 companies bear the coveted logo at present, with 20 new products being

added every day.

Everything indicates that the success story will continue in 2005. The wholesalers in the Bundesverband Naturkost Naturwaren (BNN) Herstellung und Handel registered high growth rates in the first

half of the year. The wholesale trade turnover rose by 15% over the previous year’s period to reach 281 million?EUR. "We have an upturn on a broad front. Encouragingly, all sales channels

contributed to another rise in turnover, including smaller specialized shops and farm shops, not just the organic supermarkets," comments Elke Röder, Director of BNN Herstellung und

Handel.

Top-sellers in the organic food trade are still fresh products like fruit, vegetables and milk products. The turnover in this segment rose by a disproportionately large 18% and by 11% for

groceries. Reports from the organic retail food trade are similarly positive. Here an increase of 12?% was recorded in the first half of 2005 (sales barometer of the magazine BioHandel).

Journalists can download this and other press articles and photos for BioFach free at www.biofach.com/press.